-

New User?

Credit Card Fraud and Prevention

2 mins

2 mins

What is Credit Card Fraud?

Credit Card fraud is essentially an identity theft wherein a scamster assumes your identity to gain unauthorized access to your credit card, purchase goods or conduct online transactions without your knowing or consent, with no intention of repaying the amount.

While the Reserve Bank of India has taken a lot of commendable steps like - Instructing banks to issue secure chip enabled (EMV) cards. Enabling two Factor authentications for online transactions and OTP verification for IVR/Online transactions, there seems to be no decrease in the number of Credit Card Frauds, taking place in India. One of the main reasons is the lack of awareness, especially for new credit card holders.

Types of Credit Card Frauds

Having said that, the most common credit card frauds can be categorized under these sub heads:

Skimming | Point - of - Sale (PoS Fraud)

You are most likely to fall for this kind of fraud at petrol pumps, ATMs or at retail outlets, where your credit card needs to be swiped. Here, the scamster attaches a cloning device to the PoS machine, which clones your card, without your knowledge. And then you get a shock, when you get an update that money has been drained from your account.

To be on the safer side, always double check the PoS/ATM machine for tampering, like uneven thickness of the keypad, unusual card entry slot etc, before using your card. Another way to protect yourself from getting your card Skimmed, is to get NFC enabled EMV chip credit card, which can be used to make contactless payments up to INR 5,000, simply by tapping on the NFC enabled merchant PoS machine, that too without having to key in the PIN.

If you do not have NFC enabled EMV chip credit card, always insist on DIPPING thecredit cardin the POS machine instead of SWIPING it.

Phishing | Card - Not - Present Fraud

When the scamster gets hold of vital information such as your name, credit card number, CVV number, the expiry date, and uses the same for online transactions or online purchases, it is referred to as Phishing.

The scamster gets hold of this data through data breaches, or when you click on a suspicious link and share your credit card details, while being under the impression that you are transacting online on a legit website.

Please note that SBI Card will never ask for OTP/Credit Card Number/CVV/Expiry Date, and as a vigilant SBI Credit Card holder, you shouldn't share these details with anyone, NO MATTER WHAT.

Also, NEVER click on links or open attachments received from unknown/unverified sources

VISHING FRAUD

In this fraud type, Cardholder gets a call from unknown number informing either of the following:

- Lucrative Calls- You won Reward points/a prize/Activation (such as a cruise trip, Reward points on Activation etc.,)

- Threat calls – Your card will be deactivated.

- KYC related – like KYC due or expiring etc.,

- Fake agencies (May be govt agencies or Regulators-RBI).

In order to process the above request, fraudster will collect the card information like card number, expiry, CVV and OTP. By using these details fraudster will access your account to commit unauthorized transactions.

Make sure you do not share your card details (card number, expiry, CVV) or OTP with anyone over the call.

Application Fraud

This is a type of identity theft wherein the fraudster impersonates a genuine credit card holder, through counterfeit or fake documents. Or the fraudster contacts the card issuer directly to get hold of a new credit card by impersonating someone and sharing their name, address, identity card number substantiating the same with fake documents.

In order to protect yourself from Application fraud, keep track of all your personal documents and properly shred and dispose off photocopies and redundant documents. Do not just throw them away.

Always mention the purpose on the documents while handing it over to any sales executive / third party.

Theft | Lost Credit Card

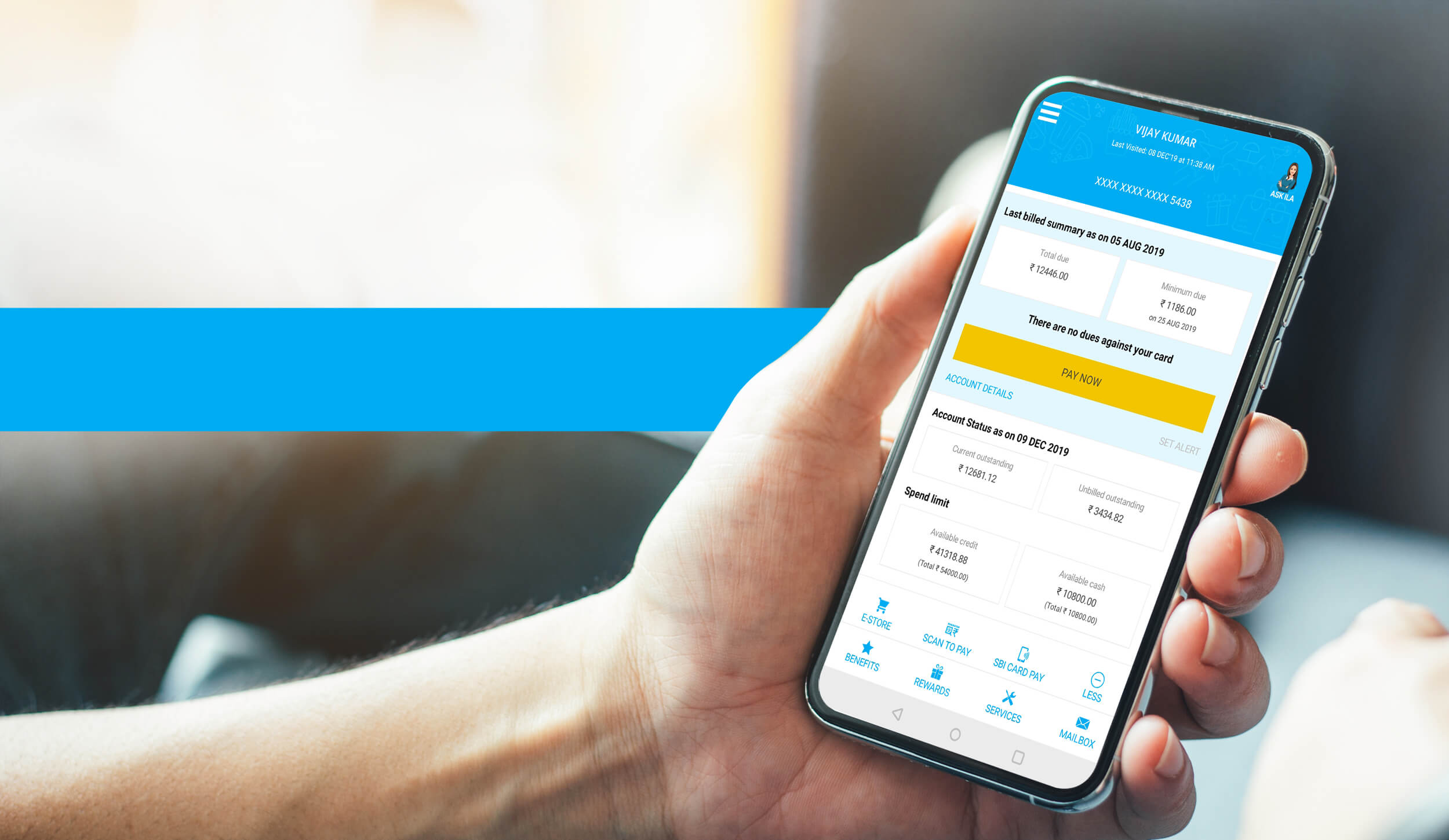

This fraud takes place when the fraudster gets hold of your lost credit card or steals it, and uses it to make purchases. The chances of you falling for this fraud is very less, if you block your SBI Credit Card via theSBI Card Mobile Appor online on the Website, the moment you lose your Credit Card.

You can also report unauthorized transactions that have been made using your SBI Credit Card by calling SBI credit card customer care number at 39 02 02 02 (prefix local STD code) or 1860 180 1290.

How to protect yourself from Credit Card Frauds?

There are plenty of ways that you as a SBI Credit Card holder can protect yourself from Credit Card Frauds. For starters, you should always sign up for Transaction alerts via SMS and Email on your registered mobile phone number and email id respectively.

You should also develop the habit of regularly reviewing your monthly credit card statements, which can be done via the SBI Card Mobile App or the SBI Card website.

When doing online credit card transactions, avoid using public WiFi networks and always make sure that the connection is secure (look out for the https:// or the small padlock symbol in the url)

Practices such as protecting your Credit Card (not leaving it unattended, nor sharing it with anyone), keeping your computer and mobile software up to date, using a strong password to login toSBICard.comor the SBI Card Mobile App, or memorizing your Credit Card CVV number (the three digit number on the back) and scratching it off can also protect you from Credit Card Frauds.

Also, DO NOT RESPOND to any call/SMS/email asking you to download an application in order to assist you online or to update documents.

This article is written by Blogger, Arnav Mathur

Related posts

- ©2026

- Do Not Disturb

- Most Important Terms & Conditions

- Offer Terms & Conditions

- Security

- Forms Central

- Sitemap

- Disclaimer

- Fair Practice Code

- Credit Bureau FAQs

- Privacy Policy/Notice

- PoSH Policy

- Order of Payment Settlement

- Cardholder Agreement

- Usage Agreement

- Customer Grievance Redressal Policy

- Customer Notices

- Tokenisation

- Procurement News

- ODR Portal Link & Circular for Shareholders

- Policy for the issuance and conduct of credit cards

- Grievance Redressal

"SBI Cards and Payment Services Limited” was formerly known as “SBI Cards and Payment Services Private Limited"

Site best viewed in browsers I.E 11+, Mozilla 3.5+, Chrome 3.0+, Safari 5.0+ on all desktops, laptops, and Android & iOS mobile/tablet devices

Previous Post

Previous Post